Pick Trust: Secure Trust Foundations for Your Building Undertakings

Pick Trust: Secure Trust Foundations for Your Building Undertakings

Blog Article

Strengthen Your Legacy With Expert Trust Foundation Solutions

Specialist count on foundation options provide a robust structure that can safeguard your assets and guarantee your desires are lugged out precisely as planned. As we dig right into the nuances of trust foundation solutions, we reveal the essential components that can strengthen your heritage and give an enduring impact for generations to come.

Advantages of Trust Fund Structure Solutions

Count on foundation options use a robust framework for guarding assets and guaranteeing lasting economic safety and security for individuals and companies alike. One of the key advantages of trust structure solutions is property protection.

In addition, trust fund structure services supply a critical technique to estate planning. Through depends on, individuals can describe how their possessions should be handled and distributed upon their passing away. This not just aids to prevent conflicts amongst beneficiaries however also makes certain that the individual's legacy is preserved and handled successfully. Trust funds additionally provide personal privacy benefits, as possessions held within a trust fund are not subject to probate, which is a public and frequently lengthy lawful procedure.

Types of Trusts for Tradition Planning

When considering legacy preparation, a critical facet involves discovering various kinds of lawful tools created to maintain and distribute properties effectively. One common type of trust used in heritage planning is a revocable living trust. This depend on permits people to keep control over their properties during their life time while making sure a smooth change of these assets to beneficiaries upon their passing away, preventing the probate procedure and providing privacy to the family members.

Another kind is an irrevocable depend on, which can not be altered or revoked once developed. This trust fund offers prospective tax obligation benefits and safeguards possessions from financial institutions. Philanthropic counts on are likewise prominent for individuals wanting to sustain a cause while maintaining a stream of revenue on their own or their beneficiaries. Unique demands trusts are important for individuals with handicaps to ensure they get needed care and assistance without threatening government advantages.

Understanding the different types of trusts available for heritage planning is critical in developing an extensive strategy that aligns with specific goals and priorities.

Picking the Right Trustee

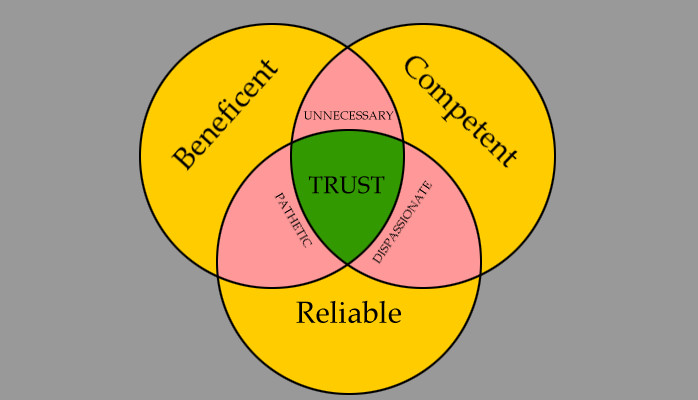

In the realm of legacy preparation, a crucial element that requires cautious consideration is the option of an appropriate individual to satisfy the pivotal duty of trustee. Choosing the appropriate trustee is a choice that can considerably impact the successful implementation of a trust fund and the fulfillment of the grantor's go to this site desires. When visit this page choosing a trustee, it is important to focus on high qualities such as dependability, monetary acumen, stability, and a commitment to acting in the very best passions of the beneficiaries.

Ideally, the selected trustee needs to have a solid understanding of economic matters, be qualified of making sound financial investment choices, and have the capacity to browse intricate lawful and tax demands. By thoroughly considering these elements and picking a trustee that aligns with the values and purposes of the trust fund, you can aid ensure the lasting success and preservation of your legacy.

Tax Obligation Ramifications and Advantages

Taking into consideration the monetary landscape surrounding depend on structures and estate planning, it is extremely important to look into the intricate world of tax implications and advantages - trust foundations. When developing a count on, understanding the tax ramifications is important for maximizing the advantages and minimizing prospective liabilities. Trust funds provide various tax benefits depending on their framework and objective, such as reducing inheritance tax, revenue taxes, and present taxes

One considerable benefit of certain count on structures is the capacity to transfer properties to beneficiaries with decreased tax obligation effects. For example, irrevocable depends on can get rid of possessions from the grantor's estate, potentially reducing inheritance tax responsibility. In addition, some counts on permit revenue to be dispersed to beneficiaries, that may be you can find out more in reduced tax obligation braces, leading to overall tax obligation financial savings for the family.

Nevertheless, it is essential to note that tax obligation regulations are intricate and subject to change, highlighting the necessity of seeking advice from with tax professionals and estate preparation professionals to make sure compliance and make the most of the tax benefits of count on structures. Correctly browsing the tax effects of trust funds can bring about significant financial savings and a much more efficient transfer of wide range to future generations.

Steps to Establishing a Depend On

The initial action in developing a trust is to clearly define the function of the trust and the possessions that will be included. Next off, it is crucial to choose the type of count on that ideal aligns with your goals, whether it be a revocable trust fund, irreversible depend on, or living trust.

Final Thought

In final thought, developing a count on foundation can supply various advantages for legacy planning, including possession security, control over circulation, and tax obligation benefits. By selecting the suitable kind of trust fund and trustee, people can secure their possessions and ensure their desires are carried out according to their wishes. Comprehending the tax obligation implications and taking the essential steps to develop a count on can assist strengthen your heritage for future generations.

Report this page